In the contemporary digital world, it seems not a week goes by without a new cyber revelation, the risks ever-present, via a growing number of potential ‘gateways’ to our personal data, whether through third parties, or our portable devices. We have recently written on this critically important area.

When we really think about it, the literal meaning of privacy can very easily takeon several different connotations, and more specifically, the right to legitimate privacy, is a personal and constitutional right of each individual. If only real life, and the new digital age were really that simple.

Looking at Commercial Analogues

The reality of achieving privacy and confidentiality for any commercial organisation is taken so seriously today that no self-respecting international organisation would be without a Boardroom role of Chief Technology Officer or similar, in turn supported by resources and a team of advisors across different assets groups, depending on the constituents of that organisation, covering both physical and digital assets – ultimately determining the management of risk.

So why should family wealth management be any different in its approach to managing risk? We would argue strongly that it starts with the correct mindset.

Not Just a Code of Conduct

Across the legal fraternity clients are protected by client privilege and across financial services advisers are clearly under the gravity of holding client records securely, providing a client with a privacy code of conduct and a framework of a working mindset that works as a pre-emptive to potential areas of risk, both existing risks that we do know about, but also making best plans as new risks emerge.

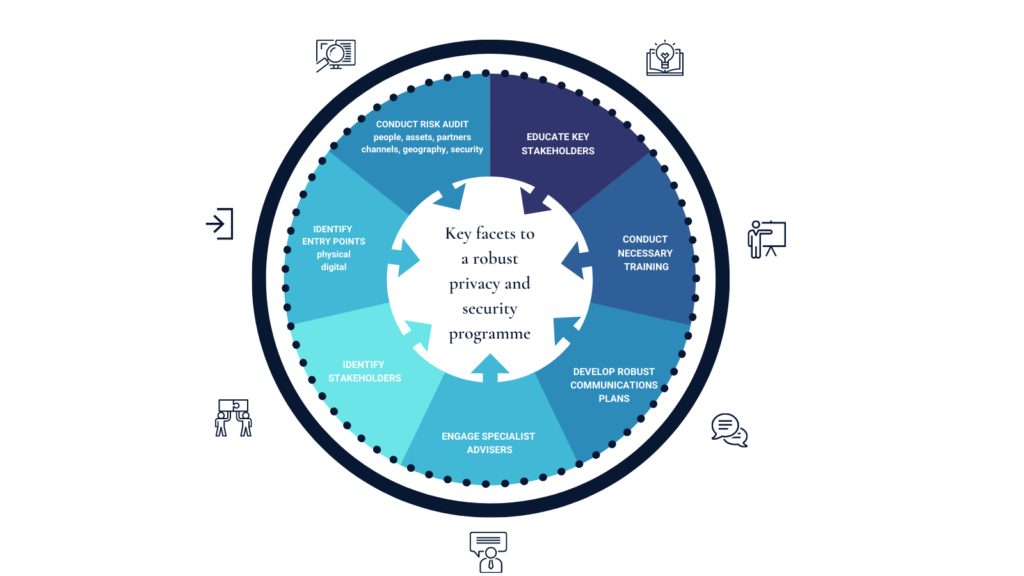

That ultimately means asking the right questions across the collective team – the stakeholders in risk management – from family members, security advisors, purchasing channels and asset partners to name a few. It’s also about careful management between other stakeholders such as regulators, often across a number of jurisdictions. As compliance reporting trends ever upwards, designed to provide greater levels of protection, at the same time it increases the compliance burden on HNWs and arguably deepens the leakage threat of legitimate areas of confidentiality.

Achieving Balance

Achieving balance between ongoing regulated disclosure requirements has to come with the ultimate legitimate privacy requirements of the HNW and, as a key corollary, the very security and safety of the individual and family members.

Ultimately, we get back to mindset. That of the client and the primary adviser to undertake a level of privacy planning that meets the client’s requirements. Planning means undertaking the key questions of the client and family group, whether dependents or otherwise, such that the present and future privacy risks are identified whilst balanced with the disclosure and confidentiality requirements of the family office.

Every Action has an equal and opposite reaction – not just the eye on the prize

A primary privacy and discretion audit should be undertaken whenever there is a change of circumstances. This could be the acquisition or sale of an asset, a change in probate or domicile, or any number of other examples we could mention that should be taken into consideration. These should all be very obvious touchpoints for a review of the impact of a change in circumstances and/or a change in strategy and there are inevitably [missing word? ME]. Whatever the required action, the mindset around it should be to review, not just the balance sheet implications, but also the read-across to the potential reputational risk, and, in that, the confidentiality exposure of undertaking a particular course of action in order to maintain legitimate privacy as a result.

Finally remembering that it can be a truly collaborative process. For example, just looking at the potential footprint of the sale of an asset requires several different types of advisers to achieve completion. As such, the mindset of privacy and discretion must be embedded in operational thinking from the very start.

Leave A Comment